Achieving financial success through investments requires careful planning and strategy. In 2024, the global financial landscape presents unique challenges and opportunities, especially with ongoing market volatility and economic shifts.

The U.S. stock market has historically returned about 10% annually, but inflation and interest rates are causing fluctuations.

Photo by Mathieu Stern on Unsplash

Diversifying your portfolio across asset classes such as stocks, bonds, and real estate, and leveraging tax-advantaged accounts are key steps to build long-term wealth. By adopting strategies like dollar-cost averaging and focusing on dividend-paying stocks, you can manage risk while maximizing returns.

If you’re a beginner or experienced investor, understanding these strategies helps you navigate economic challenges and build a secure financial future.

7 Key Investment Strategies For Financial Success

Investment success often hinges on understanding diverse strategies that help build wealth over time.

To achieve financial success, it is necessary to have a balanced approach that includes monthly income sources, long-term growth potential, and disciplined risk management. Below are seven powerful investment strategies you should know to improve your financial standing in both the short and long term.

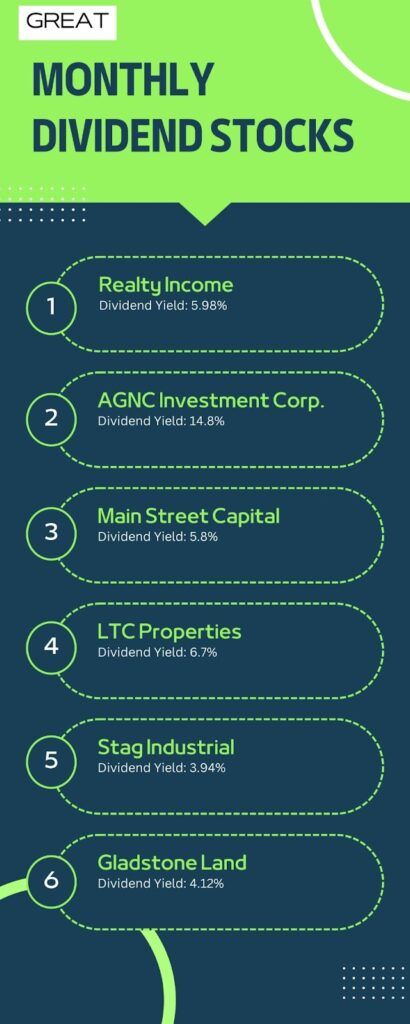

1 – Invest in Monthly Dividend Stocks

Contents

Monthly dividend stocks are a reliable income stream that pays dividends every month, unlike the more common quarterly dividends.

These stocks are especially valuable for retirees or anyone seeking regular income to cover recurring expenses. Companies such as AGNC Investment Corp., with a dividend yield of 14.8%, and Realty Income Corp., yielding 5.9%, are strong examples of monthly dividend payers.

Investing in monthly dividend stocks can also accelerate compounding, as reinvesting dividends allows for faster portfolio growth.

Keep in mind that some high-yield stocks may have less sustainable payouts, so it’s vital to evaluate their financial health regularly. It’s advisable to diversify across multiple sectors, including real estate and technology, to reduce risk.

2 – Diversify Across Asset Classes

Diversification is a critical investment strategy designed to reduce risk by spreading investments across different asset classes such as stocks, bonds, real estate, and commodities.

The performance of one asset class, such as stocks, might be poor in a downturn, while bonds or real estate might hold steady or perform better. For example, REITs (Real Estate Investment Trusts) like LTC Properties provide consistent dividends while acting as a hedge against inflation.

Incorporating a mix of assets across various industries can protect your portfolio from volatility while allowing you to capture returns from different markets.

Asset diversification is especially important in times of economic uncertainty, such as rising interest rates or geopolitical tensions.

3 – Focus on Long-Term Growth Investments

Investing for long-term growth is paramount for wealth building. Stocks, mutual funds, and index funds are excellent choices for those with a longer time horizon.

Historically, the stock market has generated an average return of 10% per year, though this fluctuates with market cycles. The key to long-term investing is to stay patient and avoid reacting emotionally to short-term market volatility.

Companies with solid fundamentals, such as Apple or Microsoft, which are industry leaders in technology, tend to perform well over long periods.

Holding onto investments through market ups and downs can help you benefit from compounding returns, turning even modest investments into substantial wealth over time.

4 – Take Advantage of Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an effective strategy to mitigate market risk by investing a fixed amount regularly, regardless of market conditions.

This approach allows you to purchase more shares when prices are low and fewer when prices are high, reducing the impact of volatility on your portfolio.

For example, investing $500 monthly in a stock or an ETF ensures that you accumulate more shares during market dips and less during peaks, helping balance your overall costs.

This strategy is particularly useful for volatile markets or when entering long-term positions like retirement accounts.

5 – Maximize Tax-Advantaged Accounts

Using tax-advantaged accounts like 401(k)s, IRAs, and Roth IRAs can significantly boost your investment returns by minimizing taxes on earnings. Contributions to traditional IRAs and 401(k)s are tax-deductible, while Roth IRAs allow for tax-free withdrawals in retirement.

It’s important to contribute as much as possible to these accounts, especially if your employer offers matching contributions.

This not only grows your wealth but also reduces your taxable income. Moreover, Roth IRAs are especially advantageous for younger investors, as their contributions grow tax-free over decades.

6 – Invest in Dividend Growth Stocks

Dividend growth stocks are companies that consistently increase their dividend payments over time. Investing in such companies offers both income and capital appreciation.

For example, Realty Income Corp. has raised its dividends for over 25 years, making it a Dividend Aristocrat. These stocks can provide a reliable income stream, and their increasing payouts help combat inflation.

Dividend growth stocks are often stable, blue-chip companies in sectors like utilities, consumer goods, and healthcare. These sectors tend to perform well during market downturns, providing an additional layer of security for investors.

7 – Regularly Rebalance Your Portfolio

Over time, some investments may outperform others, leading to an unbalanced portfolio that no longer aligns with your risk tolerance or financial goals.

Regular portfolio rebalancing involves adjusting your asset allocation to its original or desired proportions by selling over-performing assets and buying underperforming ones.

If your stock investments have grown significantly compared to your bond investments, your portfolio may have shifted towards a higher risk level than you initially intended.

Rebalancing once or twice a year ensures that your portfolio remains aligned with your goals and risk tolerance, helping to optimize long-term returns.

Photo by Austin Distel on Unsplash

Wrapping Up

Incorporating these investment strategies not only helps build wealth but also protects against market volatility, creating a stable financial foundation for the future.

As you continue to refine your financial approach, it’s paramount to stay informed about emerging opportunities, such as sustainable investing and green bonds, which are gaining popularity in 2024.

Ultimately, achieving financial success requires adaptability, continuous learning, and proactive adjustments to align your investments with evolving market conditions.